General Information

If you have more than $250,000 on deposit at the Credit Union, there are several options available for additional coverage on multiple accounts. These options are based on different ownership interests or rights in different types of accounts.

Joint Accounts

Joint accounts are owned by two or more people, each with equal rights to withdraw money. Joint account holders receive $250,000 coverage each for their aggregate interest in the account. For example, if you and your spouse have a joint account, it has $500,000 in coverage. This coverage is separate from, and in addition to, the coverage available for the other accounts such as individual accounts and retirement accounts.

Revocable Trusts

Revocable trust accounts may qualify for insurance coverage of up to $250,000 per beneficiary named by the trust owner that is separate from the individual coverage available to the owner. For example, if a person with a revocable trust for $750,000 names a spouse and two children as beneficiaries, the entire $750,000 would have separate NCUSIF coverage ($250,000 per beneficiary). This coverage is separate from the coverage provided to the other types of accounts held by the trust's owner at the Credit Union.

These are just a couple of examples! Find out more information about the NCUA or calculate your account coverage potential with the NCUA Share Insurance Estimator.

Routing numbers identify the financial institution from and to which funds are transferred. They allow companies and individuals to know which specific bank out of all banks has the account in question.

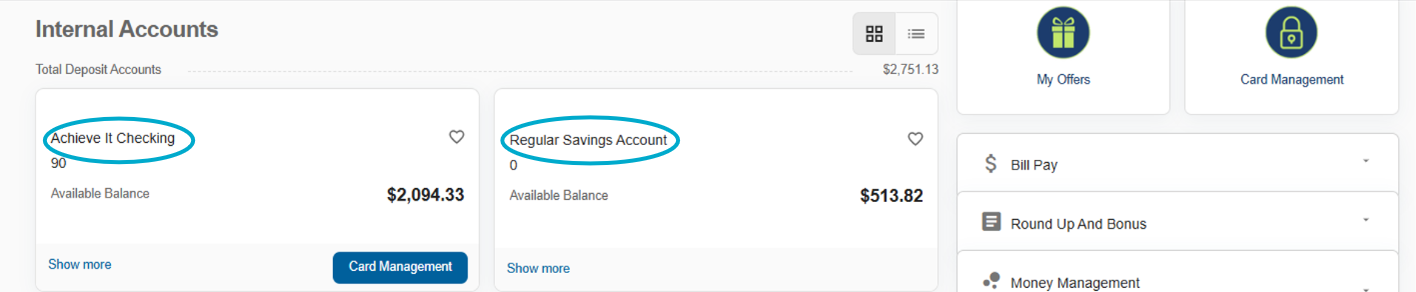

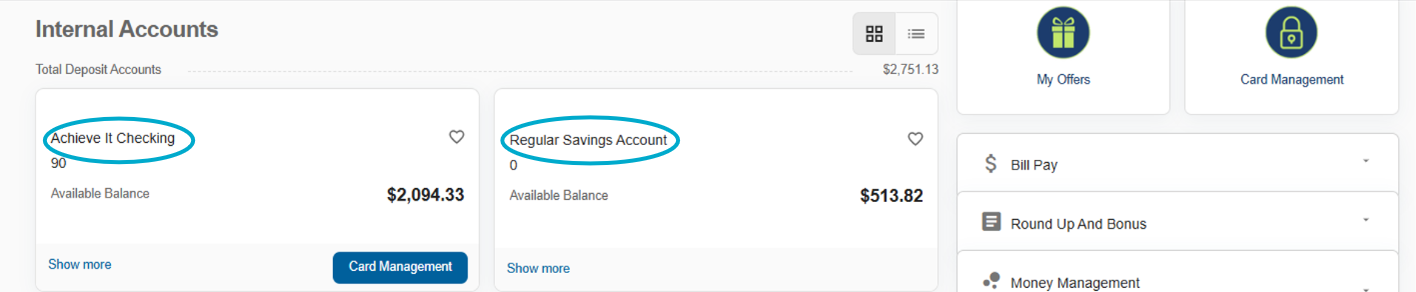

Accounts

If you have more than $250,000 on deposit at the Credit Union, there are several options available for additional coverage on multiple accounts. These options are based on different ownership interests or rights in different types of accounts.

Joint Accounts

Joint accounts are owned by two or more people, each with equal rights to withdraw money. Joint account holders receive $250,000 coverage each for their aggregate interest in the account. For example, if you and your spouse have a joint account, it has $500,000 in coverage. This coverage is separate from, and in addition to, the coverage available for the other accounts such as individual accounts and retirement accounts.

Revocable Trusts

Revocable trust accounts may qualify for insurance coverage of up to $250,000 per beneficiary named by the trust owner that is separate from the individual coverage available to the owner. For example, if a person with a revocable trust for $750,000 names a spouse and two children as beneficiaries, the entire $750,000 would have separate NCUSIF coverage ($250,000 per beneficiary). This coverage is separate from the coverage provided to the other types of accounts held by the trust's owner at the Credit Union.

These are just a couple of examples! Find out more information about the NCUA or calculate your account coverage potential with the NCUA Share Insurance Estimator.

To transfer to another member, login to OnlineAccess or MobileAccess+, go to Move Money, then Make a Transfer, and select "+Add A recipient".

Enter the first 3 characters of the recipient's last name, their account type, account suffix and member ID. Once set up, the account will be added to your 'transfer to' list in Online and MobileAccess+.

OnlineAccess:

Log in to OnlineAccess and select 'My Settings' located at the top of the screen to update your contact information.

Please note: this only changes the address of the primary account holder. If you also need to update the address of the joint account holder, call our Member Contact Center at 800-325-9905 or visit your local branch.

MobileAccess+:

Log in and select 'More' at the bottom of the screen, then the Gear icon at the top, and finally select 'My Settings' to change your information.

Please note: this only changes the address of the primary account holder. If you also need to update the address of the joint account holder, call our Member Contact Center at 800-325-9905 or visit your local branch.

In Person:

Stop by any of our branch locations to change your address in person.

By Mail:

You can mail a signed request to:

Together Credit Union

Attn: Research & Deposit

423 Lynch Street

St. Louis, MO 63118

To set up direct deposit, you will need to give your employer our routing number: 281082915, and your checking account number.

You can find your checking account number by selecting your checking account in Mobile or OnlineAccess and then clicking Account Details. It will show to the right of 'MICR'.

If you need your debit card sooner, we also provide instant-issue debit cards at our St. Louis branches and at our Shiloh, IL and Cedar Hill, TX branches.

Round-up is an optional and free feature of our Achieve It Checking account. When you opt in, your debit card transactions will be rounded up to the nearest dollar. For example, if your total came to $15.30, your debit card transaction would be rounded up to $16.00 and $0.70 would be transferred from your checking account to your preferred savings.

Note: If a debit card transaction would result in a zero or negative balance on your Achieve It Checking account, a round-up transaction will not occur.

It's an easy way to grow your savings automatically. Plus, qualifying accounts can even earn a savings match!

Can I Choose Where My Round-Up Deposits Go?

Yes! You can choose any savings, money market, or youth savings account in your membership to receive your round-up deposits. To change your preferred savings destination, log into OnlineAccess or MobileAccess+, go to Checking Round Up & Bonus, and choose "Update Settings".

How Do I Opt In or Out of Round-Up?

If you already have Achieve It Checking, you can opt in or out of Round-Up savings in Digital Banking at any time. Log into OnlineAccess or MobileAccess+ and look for "Checking Round Up & Bonus." There, you can also see how much you have saved through round-up, your progress toward earning your savings match, and more.

If you don't yet have Achieve It Checking, open an account today to start saving!

Or, if you would like to convert your existing personal checking account to Achieve It Checking, please stop by your local branch or call us at 800-325-9905.

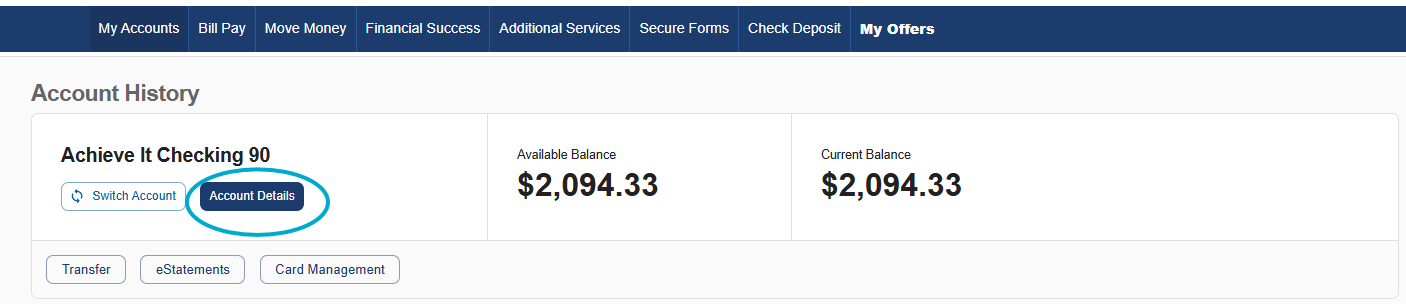

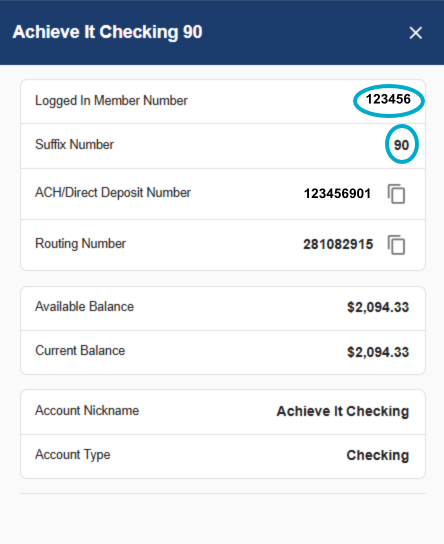

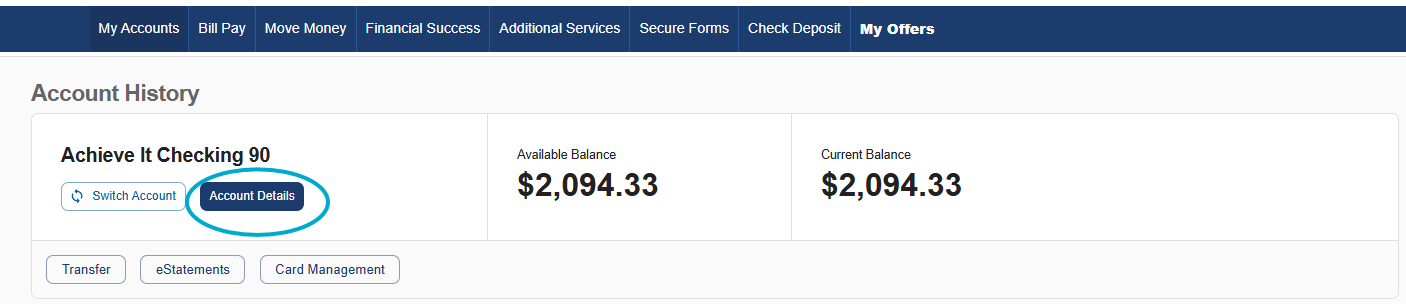

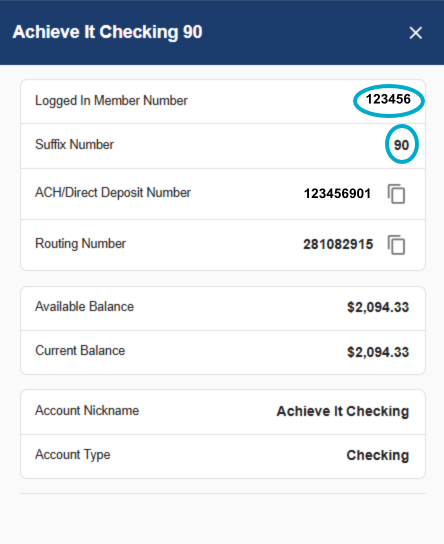

Login to Mobile or OnlineAccess. Click on your account name text (such as 'Achieve It Checking 90'), a new window will pop up and you can select the button that says 'Account Details'. From there, a sidebar will display showing your logged in member number, Suffix Number, ACH/Direct Deposit Number, Routing number and more.

Member Number:

Your member number is located in the line that says 'Logged In Member Number'.

Checking Account Number:

Your checking account number a combination of your member number and your checking account suffix (i.e. 90) + a digit (i.e. 1). For example, if your member number is 123456 and your suffix shows (90), your full checking account number would be 123456901.

Savings Account Number:

Your full savings account number is your member number + your savings suffix (i.e. 01) + a zero. For example, if your member number is 123456 and your suffix shows (01), your full savings account number would be 123456010.

Please know that we are also here to help. Please visit a local branch or call us at 800-325-9905 to notify us that the member has passed away and to begin next steps.

Once you register, you will be able to access digital banking through both our website (OnlineAccess) or our mobile app (MobileAccess+).

Please note: If all the information matches what you provided during account opening, you will be prompted to sign in right away. If not, our team will manually verify your registration for security reasons. This typically takes 1-2 business days and you will be notified via email once completed.

Learn more about OnlineAccess

Online:

Once submitted, a team member will reach out to you within 1-2 business days to confirm and complete your request.

In Person:

To learn more about becoming a youth or teen member, please visit our Youth & Teen Accounts page.

Online:

- Open a new account online in under two minutes! Apply Online.

Once submitted, a team member will reach out to you within 1-2 business days to confirm and complete your request.

In Person:

When opening a Uniform Transfers to Minors Account (UTMA) in person, you will need the following for both the parent and child:

- Valid Driver’s License/State ID, Passport, or Military ID

- Mailing Address (for both parties if they live at separate locations)

- Social Security Numbers

- $5 minimum deposit

Ready to get started? Make an appointment.

When opening an estate account in person, the executor will need to bring these items:

- Valid Driver’s License/State ID, Passport, or Military ID

- Official piece of mail in your name, such as a recent utility bill, lease agreement, financial/credit card/social security statement, etc. (Only necessary if your address is not current on the ID)

- Beneficiary information: Name, address, phone number, DOB and SSN (if possible)

- $5 minimum deposit

- Recent paystub (Necessary if you only qualify for membership through your employer)

- Death Certificate

- Letters of Testamentary (if estate is under a will filed in Probate Court)

- Letters of Administration (if estate is filed without a will in Probate Court)

Ready to get started? Make an appointment.

When opening a trust account in person, you will need:

- Valid Driver’s License/State ID, Passport, or Military ID

- Official piece of mail in your name, such as a recent utility bill, lease agreement, financial/credit card/social security statement, etc. (Only necessary if your address is not current on the ID)

- Beneficiary information: Name, address, phone number, DOB and SSN (if possible)

- $5 minimum deposit

- A recent paystub (Necessary if you only qualify for membership through your employer)

- Trustee(s) IDs

- Documentation of the Trust OR the Trust Certification

- Social Security Administration letter establishing EIN (only applicable if the Trust has its own EIN)

If you have any questions about this type of account, please call us at 800-325-9905 or make an appointment.

To open a new IRA in person, you will need:

If the funds are coming from another IRA at another financial institution:

- Financial institution's contact information

- Current financial statement

If funds are coming from an employer's retirement plan:

- The plan name

- Account number for the plan

- Employer contact information

- Most recent financial statement

Ready to get started? Make an appointment.

To open a checking or savings account in person, you will need:

- Valid Driver’s License/State ID, Passport, or Military ID

- Official piece of mail in the applicants name, such as a recent utility bill, lease agreement, financial/credit card/social security statement, etc. (Only needed if your address is not current on the ID)

- Beneficiary information: Name, address, phone number, DOB and SSN (if possible)

- $5 minimum deposit

- A recent paystub (Only needed if you qualify for membership through your employer)

Please note: Joint owners need to be present with same requirements for identification and address.

To open a checking or savings account online, you and any joint owners will each need:

- Mobile phone

- Valid Driver’s License/State ID, Passport, or Military ID

New members: Learn more about membership eligibility, find a branch or apply online today.

Existing members: Find a local branch or apply online today.

Branch Services

To report a lost cashier's check, please contact our Member Contact Center at 800-325-9905.

With account takeover fraud on the rise, we’ve added new ID-proofing security when accessing your account in person at our Shared Branch locations. This new fraud prevention measure allows us to make certain it’s YOU trying to access your account, not an imposter.

When you bank at a Shared Branch location, you can now verify your identity by scanning a QR code in the branch to authenticate and receive a one-time passcode to share with the teller.

This additional layer of security will be required for Shared Branch members with an out-of-state ID who want to make a withdrawal or transfer. Some Shared Branch locations may require it for all guest members.

Using IDCheck is secure, simple and quick!

How It Works:

- When you arrive at the Shared Branch, scan the QR code or visit verify.coop.org.

- Select Together Credit Union’s name from the drop-down list.

- Enter your member number and the last four digits of your social security number.

- Upload a photo of your ID.

- Take a selfie.

Tip: Save your validation for an even quicker experience next time!

- Show your one-time passcode to the teller or PSC

Tip: The passcode is only valid for 20 minutes. To make sure it doesn't expire, start IDCheck after you have entered the branch.

Online:

- Submit a new CD Request

A team member will reach out to you within 1-2 business days to confirm and complete your request.

In Person:

When opening a Uniform Transfers to Minors Account (UTMA) in person, you will need the following for both the parent and child:

- Valid Driver’s License/State ID, Passport, or Military ID

- Mailing Address (for both parties if they live at separate locations)

- Social Security Numbers

- $5 minimum deposit

Ready to get started? Make an appointment.

When opening an estate account in person, the executor will need to bring these items:

- Valid Driver’s License/State ID, Passport, or Military ID

- Official piece of mail in your name, such as a recent utility bill, lease agreement, financial/credit card/social security statement, etc. (Only necessary if your address is not current on the ID)

- Beneficiary information: Name, address, phone number, DOB and SSN (if possible)

- $5 minimum deposit

- Recent paystub (Necessary if you only qualify for membership through your employer)

- Death Certificate

- Letters of Testamentary (if estate is under a will filed in Probate Court)

- Letters of Administration (if estate is filed without a will in Probate Court)

Ready to get started? Make an appointment.

When opening a trust account in person, you will need:

- Valid Driver’s License/State ID, Passport, or Military ID

- Official piece of mail in your name, such as a recent utility bill, lease agreement, financial/credit card/social security statement, etc. (Only necessary if your address is not current on the ID)

- Beneficiary information: Name, address, phone number, DOB and SSN (if possible)

- $5 minimum deposit

- A recent paystub (Necessary if you only qualify for membership through your employer)

- Trustee(s) IDs

- Documentation of the Trust OR the Trust Certification

- Social Security Administration letter establishing EIN (only applicable if the Trust has its own EIN)

If you have any questions about this type of account, please call us at 800-325-9905 or make an appointment.

To open a checking or savings account in person, you will need:

- Valid Driver’s License/State ID, Passport, or Military ID

- Official piece of mail in the applicants name, such as a recent utility bill, lease agreement, financial/credit card/social security statement, etc. (Only needed if your address is not current on the ID)

- Beneficiary information: Name, address, phone number, DOB and SSN (if possible)

- $5 minimum deposit

- A recent paystub (Only needed if you qualify for membership through your employer)

Please note: Joint owners need to be present with same requirements for identification and address.

To open a checking or savings account online, you and any joint owners will each need:

- Mobile phone

- Valid Driver’s License/State ID, Passport, or Military ID

New members: Learn more about membership eligibility, find a branch or apply online today.

Existing members: Find a local branch or apply online today.

When adding a joint owner to an account, the joint owner must be present and will need:

- Valid Driver’s License/State ID, Passport, or Military ID

- Official piece of mail in the applicants name, such as a recent utility bill, lease agreement, financial/credit card/social security statement, etc. (Only necessary if your address is not current on the ID)

- Updated beneficiary information: Name, address, phone number, DOB and SSN (if possible)

When removing a joint owner from an account, you will need:

- Termination of Joint Ownership form completed and signed in person by the joint owner at the branch (or notarized if not in person)

- If joint owner is deceased, please provide a death certificate

Please stop by your local Together Credit Union branch, or call us at 800-325-9905 for assistance.

Digital Banking

Bill Pay is free for all members with a qualifying checking account!

How to enroll:

To sign up for Bill Pay, login to Mobile or Online Access, select Bill Pay, fill out the registration form and agree to the terms and conditions before submitting. It may take 1-2 business days for your account to be approved for Bill Pay.

Adding payees via MobileAccess+:

1. Sign into our mobile app

2. Select "Move Money" at the bottom of the screen, then choose "Bill Pay"

3. Once on Bill Pay homepage, select the "Payees" tab near the top. Then, you can search and add companies you want to pay.

4. Type in your billing account number and billing address, as well as a nickname to help identify the bill you're paying. Click "Add Payee" and you're ready to pay!

Adding payees via OnlineAccess:

1. Sign into OnlineAccess

2. Select the "Bill Pay" tab at the top of the page.

3. Once on the Bill Pay homepage, search and add the companies "you need to pay".

4. A window will pop up where you will type in your billing account number, as well as a nickname to help identify the bill you're paying. Click "Add Payee" and you're ready to pay!

Who can I pay with Bill Pay?

You can pay just about any payee in the United States. However, due to legal requirements, we limit the ability to make payments to payees outside of the United States.

In addition, due to their sensitive nature the following payments are discouraged, but may be scheduled at your own risk:

- Tax payments to the internal revenue service or any state or other government agency

- Court-ordered payments, such as alimony or child support

- Payments to insurance companies

We will not notify you if you attempt to make any of these payments and we will not be liable for these prohibited or discouraged payments.

You can make a payment on your loan from another financial institution through OnlineAccess or your MobileAccess+ app. In the Move Money or More menu, select Pay Your CU Loan and follow the prompts to enter your account details. Payments will take 2-3 business days to post.

You can also call our automated payment line at (888) 315-0260.

Please be sure to place your travel notice at least one business day before leaving.

- Turn your debit or credit card On/Off

- Control or block your card for specific transaction types

- Report your card lost or stolen

- Set travel notices and more!

Credit Card Tools & Features:

- Card Status (On/Off)

- Rewards

- Balance Transfer

- Alerts & Controls

- Set Travel Notice

- Duplicate Card

- Report Lost/Stolen

- Close Card

- Notifications

- Card Statements

How to Access:

For our mobile app: Select the Card Management link located on your credit card account or select the "More" section at the bottom right, and select "Card Management"

For OnlineAccess: Select the Card Management link located on your credit card account tile or select “Additional Services” and select “Card Management”

Debit Card Tools & Features:

- Card Status

- Alerts & Controls

- Notifications

- Set Travel Notice

- Duplicate Card

- Report Lost/Stolen

- Close Card

How to Access:

For our mobile app: Select the "More" section at the bottom right, and select "Card Management"

For OnlineAccess: Select “Additional Services” and select “Card Management”

Please see our Card Management Page for more details.

Heather offers:

- 24/7 account and support access

- Shorter wait times for call assistance

- Transactions including transfers, account balances, loan payments, and review of your recent transactions

- Quick answers to common banking questions

- Connection to the right representative when you need it

Apple Pay

- For Apple devices, locate and open the Wallet app (this should be pre-downloaded)

- Click the + button located in the top right portion of the screen

- Enter your debit card information

- Accept the Terms and Conditions

- You will be prompted to verify your card via text message

- Enter the code that was sent to you and you're all set!

Google Pay

- For Android users, download and open the Google Pay app

- Click the "Payment" tab at the the bottom of the screen

- Click the "+ Payment Method" button

- You are then able to take a picture of your debit card or enter the details manually

- Accept the Terms and Conditions

- You may be prompted to verify your card via text message

- Enter the code that was sent to you and you're all set!

Samsung Pay

- Android users can also download Samsung Pay via Google Play Store

- Create your Samsung account (or sign in)

- For fingerprint verification, tap "Use Fingerprint" then follow instructions (click "skip" to use the PIN method)

- Enter a backup password and tap "Continue"

- Once this setup is complete, enter your debit card information

- Accept the Terms and Conditions

- You may be prompted to verify your card via text message

- Enter the code that was sent to you and you're all set!

To transfer to another member, login to OnlineAccess or MobileAccess+, go to Move Money, then Make a Transfer, and select "+Add A recipient".

Enter the first 3 characters of the recipient's last name, their account type, account suffix and member ID. Once set up, the account will be added to your 'transfer to' list in Online and MobileAccess+.

OnlineAccess:

Log in to OnlineAccess and select 'My Settings' located at the top of the screen to update your contact information.

Please note: this only changes the address of the primary account holder. If you also need to update the address of the joint account holder, call our Member Contact Center at 800-325-9905 or visit your local branch.

MobileAccess+:

Log in and select 'More' at the bottom of the screen, then the Gear icon at the top, and finally select 'My Settings' to change your information.

Please note: this only changes the address of the primary account holder. If you also need to update the address of the joint account holder, call our Member Contact Center at 800-325-9905 or visit your local branch.

In Person:

Stop by any of our branch locations to change your address in person.

By Mail:

You can mail a signed request to:

Together Credit Union

Attn: Research & Deposit

423 Lynch Street

St. Louis, MO 63118

To set up direct deposit, you will need to give your employer our routing number: 281082915, and your checking account number.

You can find your checking account number by selecting your checking account in Mobile or OnlineAccess and then clicking Account Details. It will show to the right of 'MICR'.

Login to Mobile or OnlineAccess. Click on your account name text (such as 'Achieve It Checking 90'), a new window will pop up and you can select the button that says 'Account Details'. From there, a sidebar will display showing your logged in member number, Suffix Number, ACH/Direct Deposit Number, Routing number and more.

Member Number:

Your member number is located in the line that says 'Logged In Member Number'.

Checking Account Number:

Your checking account number a combination of your member number and your checking account suffix (i.e. 90) + a digit (i.e. 1). For example, if your member number is 123456 and your suffix shows (90), your full checking account number would be 123456901.

Savings Account Number:

Your full savings account number is your member number + your savings suffix (i.e. 01) + a zero. For example, if your member number is 123456 and your suffix shows (01), your full savings account number would be 123456010.

If you've forgotten your password, you can tap 'Forgot Login' on the MobileAccess+ login screen, or visit the OnlineAccess login page and select 'Forgot Username or Password' below the login fields.

Once you register, you will be able to access digital banking through both our website (OnlineAccess) or our mobile app (MobileAccess+).

Please note: If all the information matches what you provided during account opening, you will be prompted to sign in right away. If not, our team will manually verify your registration for security reasons. This typically takes 1-2 business days and you will be notified via email once completed.

Learn more about OnlineAccess

Cards

Please be sure to place your travel notice at least one business day before leaving.

- Turn your debit or credit card On/Off

- Control or block your card for specific transaction types

- Report your card lost or stolen

- Set travel notices and more!

Credit Card Tools & Features:

- Card Status (On/Off)

- Rewards

- Balance Transfer

- Alerts & Controls

- Set Travel Notice

- Duplicate Card

- Report Lost/Stolen

- Close Card

- Notifications

- Card Statements

How to Access:

For our mobile app: Select the Card Management link located on your credit card account or select the "More" section at the bottom right, and select "Card Management"

For OnlineAccess: Select the Card Management link located on your credit card account tile or select “Additional Services” and select “Card Management”

Debit Card Tools & Features:

- Card Status

- Alerts & Controls

- Notifications

- Set Travel Notice

- Duplicate Card

- Report Lost/Stolen

- Close Card

How to Access:

For our mobile app: Select the "More" section at the bottom right, and select "Card Management"

For OnlineAccess: Select “Additional Services” and select “Card Management”

Please see our Card Management Page for more details.

Apple Pay

- For Apple devices, locate and open the Wallet app (this should be pre-downloaded)

- Click the + button located in the top right portion of the screen

- Enter your debit card information

- Accept the Terms and Conditions

- You will be prompted to verify your card via text message

- Enter the code that was sent to you and you're all set!

Google Pay

- For Android users, download and open the Google Pay app

- Click the "Payment" tab at the the bottom of the screen

- Click the "+ Payment Method" button

- You are then able to take a picture of your debit card or enter the details manually

- Accept the Terms and Conditions

- You may be prompted to verify your card via text message

- Enter the code that was sent to you and you're all set!

Samsung Pay

- Android users can also download Samsung Pay via Google Play Store

- Create your Samsung account (or sign in)

- For fingerprint verification, tap "Use Fingerprint" then follow instructions (click "skip" to use the PIN method)

- Enter a backup password and tap "Continue"

- Once this setup is complete, enter your debit card information

- Accept the Terms and Conditions

- You may be prompted to verify your card via text message

- Enter the code that was sent to you and you're all set!

If you need your debit card sooner, we also provide instant-issue debit cards at our St. Louis branches and at our Shiloh, IL and Cedar Hill, TX branches.

What is myCITY+?

myCITY+ is an exclusive membership experience created by St. Louis CITY SC to give the team's most loyal fans additional perks and benefits throughout the soccer season. It normally costs $50 to join, but is FREE to all CITY Debit or Credit Card holders.

CITY SC Fan Perks include:

- Express entry to all STL CITY SC home matches

- Free myCITY+ Membership*, which includes:

- 10% Cash Back on Food & Beverage purchases at all STL CITY SC home matches

- 10% Cash Back on STL CITY SC retail items at CITY Goods and CITY Pavilion or inside the stadium on matchday (some exclusions may apply)

- Priority Access to purchase tickets to single game matches before the general public

- Priority Access to purchase tickets for CITY-hosted events and non-MLS events, when available

- Priority pre-sale opportunities

- CITY Season Ticket waitlist access

- Annual fan gift

- Exclusive giveaways and more! (Available to a limited number of cardholders on a monthly automatic opt-in sweepstakes basis)

Report your card as lost or stolen in the Card Management feature in Online or Mobile Access and then please contact us immediately to file a claim at 1-866-642-6105 for debit cards, or 1-866-605-5384 for credit cards.

You may request a duplicate to replace a card that is damaged. The card number stays the same, but the Expiration Date and CVV will change on the new card

From the date of enrollment for e-statements, the system will retain monthly statements for 24 months.

Loans

At Together Credit Union, we understand circumstances can cause unexpected financial stress for our members. Our team remains ready to support you through financial challenges as they come.

If you're dealing with a temporary loss of income, need help managing expenses, or just want to explore your options, we’re here to help you every step of the way.

Support available to you:

- Flexible payment options and loan assistance

- Personalized financial guidance

- Relief program for impacted members

Help With Immediate Expenses With Our Relief Loan

For unexpected expenses or for additional help please contact our Lending Center at 314-657-9635 or email us.

Already Have a Loan with Us?

Our Skip-A-Pay Program may help if you’re experiencing income loss or difficulty making payments.

Beginning with the 2025 tax year, qualifying members may be able to deduct interest paid on qualifying new auto loans.

This potential tax benefit could help lower your taxable income and put more money back in your pocket.

Here's what you should know about this new rule:

- Applies to qualifying new auto loans taken out after December 31, 2024

- Annual deduction is available up to set limits under IRS rules

- The loan must be secured by the vehicle and meet IRS eligibility requirements

For full details on how this new ruling may impact your auto loan, please review our Auto Loan Interest FAQ and speak with a qualified tax professional.

If your vehicle has been declared a total loss, Together Credit Union is here to guide you through the process of finalizing your loan and ensuring all documentation is handled smoothly.

Please email all total loss Letter of Guarantee requests to:

logr@togethercu.org

To facilitate completion of the Letter of Guarantee for your claim, please provide the following:

- Letter of Guarantee Request

- Copy of the Police Report or Cause of loss letter outlining the type and description of the loss

- Settlement Breakdown

- Documentation for Any Prior Damage or Previous Payments to the collateral

- Vehicle Evaluation, including: Date of loss, Mileage, & Claim payment amount

To request a payoff quote, please call: 1-800-325-9905

Learn more: Total Loss Claims

Loan Payment Options:

- In Online Access and Mobile Access+:

- For auto, home, or personal loans: Select "Move Money" and choose "Pay Your CU Loan"

- For credit card payments: Select "Move Money" and choose "Transfer between my CU Accounts."

- To pay your credit card from an account at another bank or credit union, first add that external account using the "To/From External Accounts" option and move the funds to your Together CU checking or savings account. You can then make your credit card payment using "Transfer". - By Phone: Call 1-888-315-0260

- Using a non-Together Credit Union debit card: Log in to the SWBC Payment Center to pay using a debit card from another credit union or bank. You may need to register if it is your first time using the service.

- By Mail: You can mail your payment to PO Box 27057, St. Louis, MO 63118. Please include your member number and loan suffix on the memo line of your check (these can be found on your statement.) If you prefer to enclose a loan coupon, you can fill out and print coupons here.

You can make a payment on your loan from another financial institution through OnlineAccess or your MobileAccess+ app. In the Move Money or More menu, select Pay Your CU Loan and follow the prompts to enter your account details. Payments will take 2-3 business days to post.

You can also call our automated payment line at (888) 315-0260.

You should bring the title with you when the loan is closed.

If you live in a title holding state, that state will mail you the title.

If Together Credit Union has the lien on title and you are not in a title holding state, the title will be kept by the Credit Union until the loan is paid off.

Moving

If you moved to a new state and need to register your vehicle, you will need to contact your local DMV and the DMV will notify Together Credit Union that you have moved and wish to register your title in their new state. We will then mail the title to that DMV.

Name Changes

If you would like to change the name on the title, a proof of name change will need to be provided and we will mail in the request for a fee (that state's processing fee).

Title Replacement

To get a replacement title on a loan that has been paid off, we will issue a lien release for you to get a clear title from your local DMV. Give the Member Contact Center a call at 800-325-9905 for assistance. If the vehicle still has a lien in place, you will need to visit your local DMV and apply for a lost title. Together Credit Union does not replace titles.

Online:

- Submit a Loan/Credit Card Application

Once submitted, a team member will reach out to you within 1-2 business days to confirm and complete your request.

In Person:

If you have any questions about applying for a loan with Together Credit Union, please contact our Lending Center at 800-325-9905, via our Lending Center Direct Line at 314-657-9635 or via email lendingcentermcc@togethercu.org.

Fraud & Security

Please be sure to place your travel notice at least one business day before leaving.

If you believe your debit or credit card may have been compromised, you can also temporarily turn it off to prevent further activity. To turn your card off, log in to MobileAccess+ or OnlineAccess and select More or Additional Services, then select Card Management. You will see Card Status On/Off toggle. This change takes effect immediately.

Learn more about Fraud Protection.

With account takeover fraud on the rise, we’ve added new ID-proofing security when accessing your account in person at our Shared Branch locations. This new fraud prevention measure allows us to make certain it’s YOU trying to access your account, not an imposter.

When you bank at a Shared Branch location, you can now verify your identity by scanning a QR code in the branch to authenticate and receive a one-time passcode to share with the teller.

This additional layer of security will be required for Shared Branch members with an out-of-state ID who want to make a withdrawal or transfer. Some Shared Branch locations may require it for all guest members.

Using IDCheck is secure, simple and quick!

How It Works:

- When you arrive at the Shared Branch, scan the QR code or visit verify.coop.org.

- Select Together Credit Union’s name from the drop-down list.

- Enter your member number and the last four digits of your social security number.

- Upload a photo of your ID.

- Take a selfie.

Tip: Save your validation for an even quicker experience next time!

- Show your one-time passcode to the teller or PSC

Tip: The passcode is only valid for 20 minutes. To make sure it doesn't expire, start IDCheck after you have entered the branch.

Business Banking

- Federal Tax ID Number Letter (EIN Letter): You can obtain an EIN from the IRS at irs.gov.

- Current Bylaws: Outline your organization’s purpose, leadership structure, decision-making process, and who is authorized to manage funds. This helps verify legal authority to open and manage the account.

- Meeting Minutes: Signed (Preferably on letterhead), authorizing the account opening and identifying individuals authorized to act on the organization’s behalf.

- Fictitious Name Registration / Certificate of Assumed Name (if applicable): Required if your business operates under a different name than your legal entity name. Also known as a DBA form.

- Registration of Foreign Entity (if applicable): Required if your business was originally formed in another state and is now conducting business in the state where the account is being opened.

- Federal Tax ID Number Letter (EIN Letter): You can obtain an EIN from the IRS at irs.gov. Alternatively, Sole Proprietorship Owners may use their Social Security Number (SSN).

- Certificate of Good Standing: Confirms your current registration status with the Secretary of State’s office.

- Fictitious Name Registration / Certificate of Assumed Name (if applicable): Required if your business operates under a different name than your legal name. Also known as a DBA form.

- Registration of Foreign Entity (if applicable): Required if your business was originally formed in another state and is now conducting business in the state where the account is being opened.

- Federal Tax ID Number Letter (EIN Letter): You can obtain an EIN from the IRS at irs.gov.

- Certificate of Good Standing: Confirms your current registration status with the Secretary of State.

- Signed Partnership Agreement: Outlines roles, ownership percentages, and structure; required to verify who is authorized to act on behalf of the business.

- Fictitious Name Registration / Certificate of Assumed Name (if applicable): If operating under a name different from the legal partnership name, it must be registered with the Missouri Secretary of State. Also known as a DBA form.

- Registration of Foreign Entity (if applicable): Required if your business was originally formed in another state and is now conducting business in the state where the account is being opened.

- Federal Tax ID Number Letter (EIN Letter): You can obtain an EIN from the IRS at irs.gov.

- Articles of Incorporation and Certificate of Incorporation: Filed with the state to legally form your organization. Confirms your business name, corporate structure, and date of formation.

- Current Bylaws: Outline your organization’s purpose, leadership structure, decision-making process, and who is authorized to manage funds. This helps verify legal authority to open and manage the account.

- Meeting Minutes: Signed (Preferably on letterhead), authorizing the account opening and identifying individuals authorized to act on the organization’s behalf.

- Fictitious Name Registration / Certificate of Assumed Name (if applicable): Required if your business operates under a different name than your legal entity name. Also known as a DBA form.

- Registration of Foreign Entity (if applicable): Required if your business was originally formed in another state and is now conducting business in the state where the account is being opened.

When applying for a business account, you will need:

- Business owner's social security number

- Personal information for all signers including:

- Copy of driver’s license and business titles

- Business tax ID and SIC code

- Date the business was established

- Current business address

- Additional documentation based on type of business:

- Sole Proprietorship – certification of assumed name

- Partnership – partnership agreement and registration of fictitious name

- Corporation – articles of incorporation, evidence of corporate existence or good standing and annual registration report

- Limited Liability Company – articles of organization, operating agreements and certificate of existence or good standing

- Unincorporated Association or Organization – certification signed by secretary authorizing signatory and copy of by-laws

New business members: Learn more about membership eligibility or make an appointment today.

Existing business members: Learn more about Business Account options or make an appointment today.