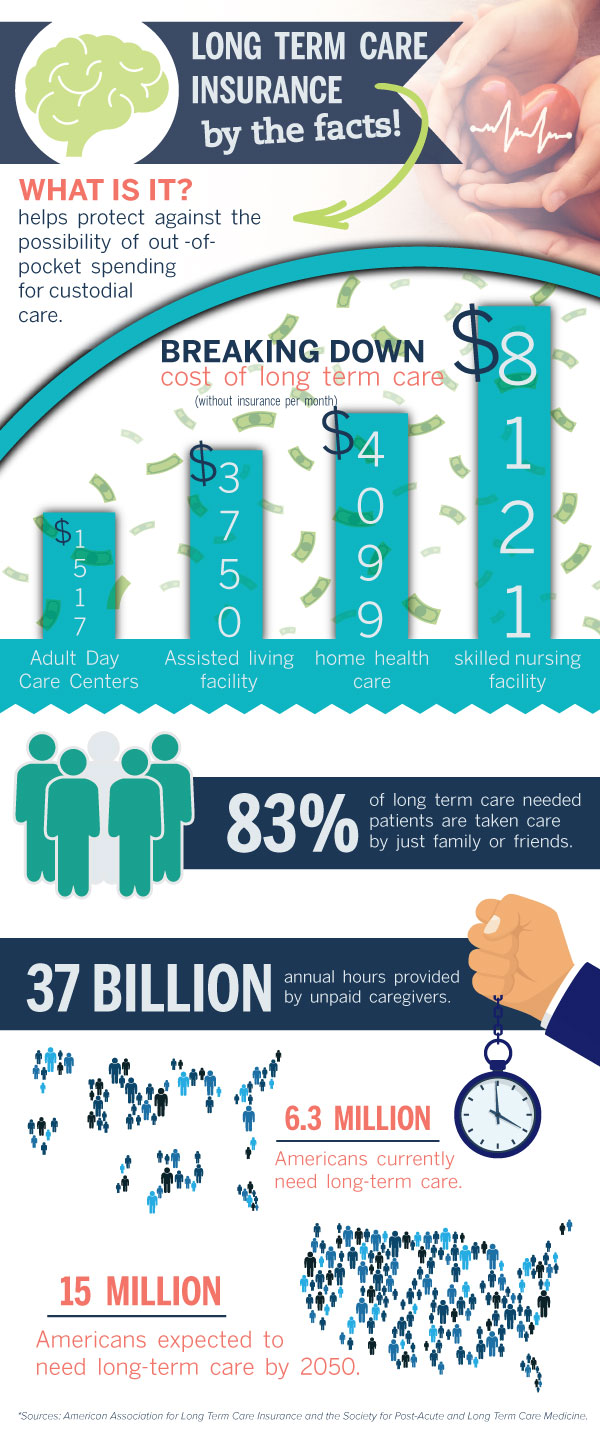

Long Term Care Insurance

Long-Term Care insurance provides financial protection

and offers peace of mind in a world full of uncertainties.

If recent times have taught us anything, it's that life is unpredictable.

A little planning goes a long way.

- The likelihood of needing long-term care increases as you age.

- Regular health insurance does not cover most long-term care services.

- Medicare does not pay for most long-term care services.

- Medicaid may pay for some long-term care — if you qualify.

We can help too! For questions, please call our Financial Services Coordinator, Diane Stockwood at 314-657-9671 or email her at [email protected]

Hear from our own people on the importance of Long Term Care:

Demi Bohr, Organizational Effectiveness Consultant

“The turning point for me was when I recognized the wide age range of people living in the nursing home where I worked.

I thought nursing homes were only available to older individuals, and it was far from that. We had individuals in their 20’s who ended up there from life-threatening events, which left them dependent on long term care.

You really never know what’s going to happen to you, but if something traumatic does happen, you could be placed in a home.

I thought to myself… ‘At any point in my life this could be me’, and I would have to be financially ready for it.”

Bob McKay, Chief Executive Officer

“It’s very important to plan for the future and to protect your assets.

Long Term Care Insurance provides the opportunity for our members to learn about the expectations as they and their families get older, and the need for health care significantly changes.

We want to make sure that we are there for them to provide the tools, programs and most importantly the education about being prepared and understanding what is likely to happen when we get older.

That is why we started this program.”

Additional Facts:

Helpful Article:

3 Ways to Prepare Your Aging Loved Ones for the Next Crisis »

Online Access Login

Online Access Login Apply for Loan

Apply for Loan

Open an Account

Open an Account Make A Payment

Make A Payment

AD&D Insurance

AD&D Insurance

HowDoYouCU? Follow our blog!

HowDoYouCU? Follow our blog!